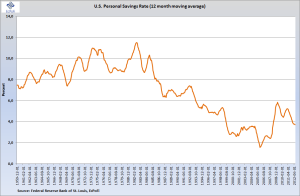

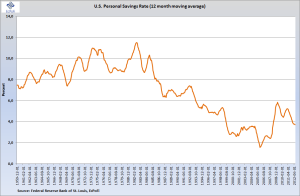

Chances are, if you live in America, you have experienced the endless barrage of marketing tactics designed to entice you to buy some material good. It really seems that there is just no end to the list of items that “we just have to have.” It is for this reason, and others, that the personal savings rate of Americans has dropped significantly over the last several decades. The following chart shows data collected by the St. Louis Fed for the personal savings rate from 1959 – 2012:

Unfortunately, the savings rate did not improve in 2013, coming in at a paltry 4.48%. Since the personal savings rate is calculated by dividing personal savings by disposable income, these figures and the reality they represent are certainly alarming, as they indicate that people are hardly saving at all. This should be disconcerting for some, as they enter their retirement years with little to show for their efforts during their working years.

On one financial site recently, columnist Dayana Yochim wrote an article regarding retail tricks that make people overspend. A couple of the marketing tactics that she uses as examples include the “buy now or regret later” tactic. This is used by retailers like Costco, as well as others, when the store constantly changes out some of their items, so that consumers are more tempted to buy an item when they see it, rather than run the risk that the item will be unavailable the next time they visit the store.

Another marketing tactic to lure consumers into buying more than they need is the “more is better and cheaper” tactic. This tactic ostensibly offers discounts for purchasing in bulk or volume. However, when people overspend by purchasing more than they need, but then do not use some or all of the goods, it is wasteful first of all, but also takes money out of the consumer’s pocket that could have instead been put into savings, potentially earning money in perpetuity.

Another issue that should be considered in a discussion of personal savings is that savers can presently earn very little on their savings. This is because interest rates are currently very low, so personal savings vehicles like savings accounts, money market accounts, and cd’s pay minimally on money parked in them. This creates a disincentive for people in terms of saving, because why should someone save money if they can’t earn money on that savings.

So, what is the answer to our personal savings dilemma? Well, one thing is personal discipline. Rather than continually putting disposable income into non-income-producing material goods, instead put that money into investments that will produce an income for years to come. To solve the low interest conundrum, put extra money into equity assets that grow over time, rather than interest-rate-based accounts, where depositors are paid very little (at least for now) to park money there.