The above picture demonstrates how some market participants feel as they try to navigate the choppy waters of an unpredictable stock market. Both amateur investors and seasoned pros alike spend countless hours trying to make sense of it all, and with good reason. If you think about it, none of us are truly immune to the rises and falls of the market or the economy in general, as all of our futures (at least financially) are inextricably linked to the system in which we live, move, and have our being.

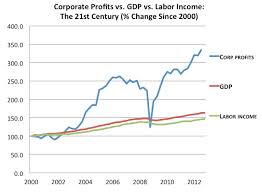

In my study recently, I came across an essay by a guy by the name of Chris Brightman. In this essay, Brightman covers the issue of corporate profits, which are at historic highs relative to both GDP and GNP. (Please see the chart below: Corporate Profits vs. Nominal GDP.) Brightman’s prediction is that moving forward, because things always revert back to the average, the market will falter, as corporations face political pressure to increase spending on labor, thereby decreasing their ability to put profits back into the corporation in the form of capital spending. (Please see the chart below: Corporate Profits vs. GDP vs. Labor Income.)

However, columnist Sam Ro takes a contrarian viewpoint in a recent article in Business Insider called “Here’s What The Bears Get Dead Wrong About This Controversial Corporate Profits Chart.” In Ro’s view, the issue of corporate profits to GDP has been minimized in recent years as a result of the international exposure of corporations. Many corporations today accrue profits through their global constituents, and these numbers may not even enter the GDP equation. Ro ends his column by concluding that profit “margins are on a secular upswing thanks to increasing overseas exposure among other things.”

In closing, it is essential regarding your financial health to come to the realization that no one can accurately predict short-term movements in the stock market. The wisest and most profitable strategy is to choose a globally diversified portfolio of investments and then maintain discipline by staying the course for the long-term. Of course, the portfolio needs to be monitored and re-balanced regularly throughout the course of life, and you should certainly work with your financial adviser to accomplish this.

Having global diversity gives one a much larger playing field in regards to their investments .

Thanks for the comment, Shawn