Over the years, I’ve thought a lot about the idea of retirement. When I was in my early 20’s, I accepted the traditional American notion of it, basically without question. However, as I have grown older, and have personally witnessed the change and uncertainty that life brings, I have changed my thinking considerably.

The fact is, the idea of retirement is a fairly new one when considered in the context of human history. Before the early 1900’s, there was really no thought of “retirement” as we think of it today. The idea really took hold in 1935, with the passage of the Social Security Act. However, at that time, life expectancy was 62, while the age picked for retirement by the new law was 65, leaving few people living long enough to enjoy retirement bliss.

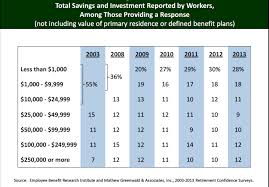

Now, things have changed considerably. With improved health care, people are living longer. However, although many of these people have ostensibly worked all their lives to save for retirement, many of them do not have a large enough nest egg stashed away to last the thirty or forty years they plan to live in retirement. This has led to a greater number of people re-entering the workforce after age 65. (Please see the images below.)

I recently read an article on the Forbes website written by Carolyn McClanahan that I believe gives great advice related to the idea of retirement. In the article, McClanahan gives two pieces of advice regarding retirement thinking: 1) Create a great life now; 2) Prepare for the uncertainty of the future.

The first point here is very important, I believe, because it can create a greater sense of happiness for people. Why spend the great majority of your life doing something you hate just to save for an uncertain future. If you do not love your work, then change, and do something that you do love, even if this means less money in the short-term. Doing this will most likely allow you to live and even earn longer, but enjoy the process as well.

The second point is equally important, because it takes into consideration the reality of life. The fact is, the only thing certain about the future is uncertainty, and this should be fully realized as part of the financial planning process. Learn to balance your “needs” versus your “wants.” This will allow you to save more toward an uncertain future. Additionally, it will point you toward personal growth and a balanced life, as you realize that the pursuit of material things alone does not lead to balance and fulfillment. However, a life filled with experiences with the people you care most about, while at the same time having your needs met, does lead to a balanced and fulfilled life.